For investors

ENERTRAG's financial products are not only an attractive investment, but also actively support the energy transition.

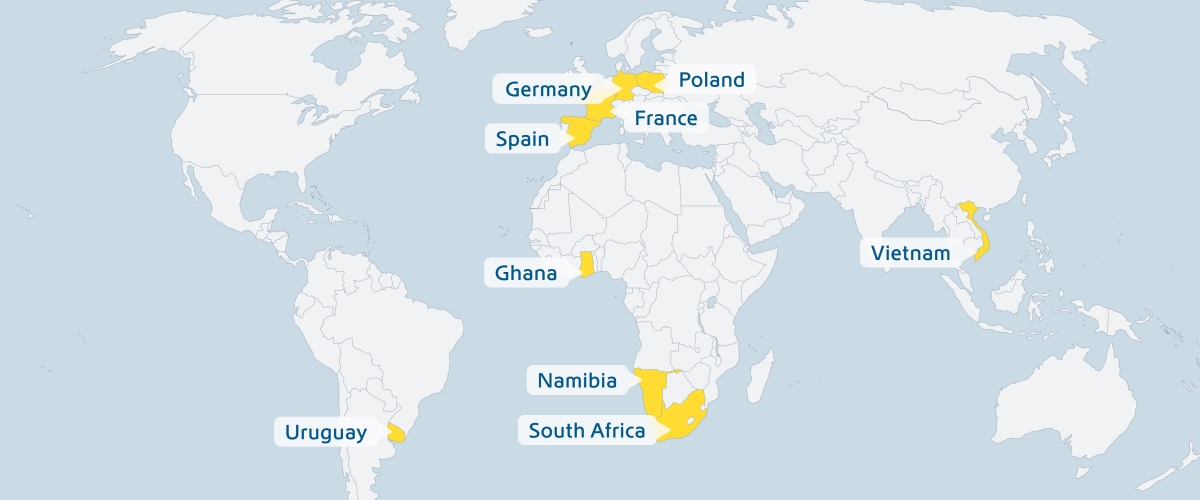

For ENERTRAG, the energy transition means more than just producing renewable electricity. ENERTRAG's decision to build its own grids, to keep renewable energy plants in its own portfolio, to rely on green hydrogen in the integrated power plant and to focus on the right regions worldwide at an early stage shows that ENERTRAG is acting with foresight.

This is also reflected in ENERTRAG's financial offers. The last few years in particular have shown how dynamically and rapidly markets change and how quickly prices multiply. For this reason, ENERTRAG has added a flexible component to the well-known classic corporate bond with all its advantages.

Answers to frequently asked questions

Recommend ENERTRAG financial products and receive 100 euros

Referrals are rewarded at ENERTRAG. If the person who was referred subscribes directly to an ENERTRAG investment, the referrer receives a one-off bonus of 100 euros.